What I studied at Australia's best university

Photo Credit: The Faculty of Business and Economics, corner of Barry St and Pelham St, Carlton VIC 3053

Photo Credit: The Faculty of Business and Economics, corner of Barry St and Pelham St, Carlton VIC 3053Most accountants start their career with a Bachelor Degree. Some study full Accounting (Bachelor of Accounting), some major in Accounting (Bachelor of Business major in Accounting), and some study something else (Bachelor of Engineering) but decide to become an Accountant later on. For me, it was the second pathway through the Bachelor of Commerce (Major in Accounting and Finance) at the University of Melbourne. I was very lucky to study at such a prestigious university with a high ranking in business subjects.

In this article, I will briefly review the structure of the degree. Thus, prospective students can grasp a sense of the learning milestones ahead. Note: I graduated in 2017 so some of the details may have changed.

The Bachelor of Commerce (BCom) was the only Undergraduate degree within the Faculty of Business and Economics (FBE). There were 24 units, spanning three years. Students started with the Core units in their first year and chose their Major(s) in the second year. Besides that, Breadth and Elective units were available to complement or expand the learning experience. There were six Majors to choose from Actuarial Studies, Accounting, Economics, Finance, Marketing, and Management. Students could combine any two of the latter five to form double majors. Actuarial Studies was about financial risks (think complex mathematics), which was in a league of its own.

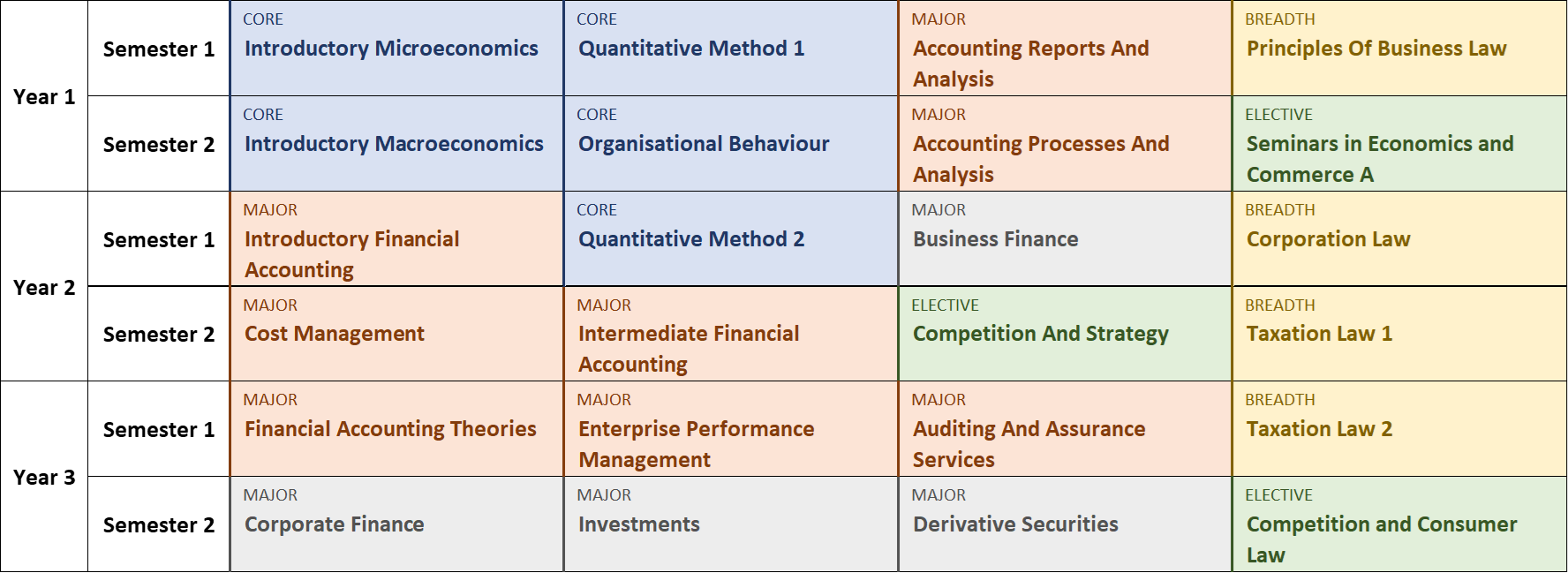

Sample of a study plan

Core

All students that studied the BCom must complete the Core units, regardless of major. These units were supposed to provide a foundation for business acumen. There were introductory units in Micro and Macroeconomics, two Quantitative Methods units (Statistics) and Organisational Behaviour. Micro/Macroeconomics were useful to know. Businesses operating in any economy, whether domestic or international, would be influenced by Micro/ Macroeconomic factors (supply/demand, government policies, trading, investment). Accountants do not use economic theories in daily tasks but an understanding of the elements involved will help provide appropriate advice to clients. The Quantitative Methods units did not provide much useful knowledge in my opinion. They taught advanced maths models that would be relevant for future Economists rather than future Accountants. I wished they replaced these courses with Excel and/or Accounting Software for students who opted for an Accounting Major. That would be much more relevant from a job-ready perspective. Organisational Behaviour was another good-to-know but rarely used unit. It explored how individuals and groups interacted in organisations. The topics covered motivation, ethics, culture, communication, conflict, power and changes. I found this unit quite challenging due to the vast knowledge to distil in just one semester.

Elective

Students could choose any units taught by the FBE as Electives to complement their study. My suggestion is to choose units that you find interesting. You will, then, enjoy the learning experience, and boost your GPA at the same time. I enrolled in the following three:

Seminar in Economics and Commerce A

Only students who achieved a GPA (WAM at UniMelb) over 80 in their first semester were invited to join this elective unit. The lecturer explained the history and development of economic theories. It was super interesting but completely irrelevant for Accountants.

Competition and Strategy

This unit focused on Game Theory, which was a concept introduced in Microeconomics. I was intrigued by the nature of the principles involved so I enrolled in Competition and Strategy to discover further. The content was fascinating. It explored how firms reacted to each other’s behaviours, depending on the market and the type of decision. It was somewhat relevant for Accountants when analysing strategic options for clients.

Competition and Consumer Law

As the name suggested, this unit covered Competition and Consumer Laws, as outlined in the Competition and Consumer Act 2010. This unit helped spot illegal business activities, which was absolutely useful, especially in daily life. I really enjoyed learning about cartel conducts in business and consumer protection mechanisms.

Accounting Major

Accounting is a very broad field. The Accounting Major focused on three topics that the majority of students would likely work with as future accountants: Financial Accounting, Management Accounting and Auditing.

Financial Accounting units taught students how to record transactions, prepare/ analyse/ interpret financial statements. The most challenging components in Financial Accounting were accounting for income tax and consolidated financial statements (for a group of related companies). The users of financial accounting information are mainly external parties (government, investors, banks, suppliers). Hence, there is a strong emphasis on the reliability and relevance of the information reported. These two characteristics are often in a reversed relationship and students learn how to balance them.

Management Accounting focuses on cost management (design and implementation of cost management systems) and performance management control systems (performance measurement, reward systems, profit analysis, planning and budgeting). The management team mostly uses Management Accounting information to inform their decision-making. Students learn to combine both quantitative and qualitative data when advising management. Once again, students are taught to balance the use of these two types of data.

Studying Auditing involved understanding the flow of accounting transaction data to accounting reports, and the role of Auditors in examining financial statements. Auditors simply cannot verify every single transaction. They need to determine the areas that need more attention and establish the appropriate testing threshold to avoid missing fraudulent transactions.

Many people think Accounting is for number nerds. However, as you can see above, there is the art of balancing in every accounting task. In addition, Accountants also interact with parties inside and outside of the organisations. This implies good communications skills are needed.

Photo Credit: Towfiqu Barbhuiya @ Unplash

Finance Major

Finance professionals may disagree but I think Finance broadly focuses only on two topics: raising funds and allocating those funds to investment opportunities, or what I like to call Corporate Finance and Investment. I chose to also major in Finance as it was the most related major to Accounting. Accountants need to record and evaluate projects, capital and investments. Therefore, knowledge of Finance concepts is a huge advantage.

Corporate Finance explained the different techniques used by firms to raise equity and debt capital, and related topics. In accounting language, Corporate Finance studied the liability and equity sections on the statement of financial position, from a Finance perspective.

Investment explored different equity and fixed-interest securities, as well as the methods to evaluate them. This is linked to financial assets on the balance sheet that Accountants need to report at the end of the reporting period. If you do not want to study the Finance Major, I still recommend picking up the Investment unit because it will help you make sound investment decisions later on in your life.

There was a special topic on Derivative Securities, which could act as speculative investments or insurances. Accountants encounter derivative securities in hedge accounting, a highly specialised and challenging area. Usually, only multinational companies require this function.

Overall, I found the Finance Major relatively interesting and useful. There were some maths involved, but nowhere near as advanced as Quantitative Methods.

Photo Credit: Kanchanara @ Unplash

Breadth

At UniMelb, students who study for the BCom were required to study four units taught by other faculties. This gave students a chance to explore units or disciplines outside of commerce and finance. However, if you chose to major in Accounting, like me, you would fill the Breadth options with Business-related Law units, from the Law Faculty. These law units were for accreditation with CPA/CA and the Tax Practitioners Board. If you did not take these Law units, you would have to study extra subjects when you eventually take on the CPA/CA program or the Tax Agent program. Having said that, I was not complaining because society operated under the laws. Thus, understanding laws would be helpful in general. I would encourage students to study some law units regardless of their degree.

Business Law introduced the law from a business perspective, including how laws were made and changed, how contracts were created/ enforced/ remedied if breached, and liability in tort law for negligence.

Corporation Laws examined the Corporations Act 2001, which governed the formation, management, financing and winding up of Australian corporations. Accountants often find themselves working for corporations, thus knowledge of the Corporations Act is extremely crucial.

Taxation Laws covered a wide range of tax topics: taxes for individuals, taxes for different types of businesses (companies, trusts and partnerships), international taxation issues, superannuation and state taxes. Interpreting and applying the laws required a lot of logical thinking, and I liked that a lot.

According to Benjamin Franklin, “in this world, nothing can be said to be certain, except death and taxes''. Understanding taxes pretty much gives students an upper hand in life. If they study tax properly, they may not even need to hire a tax agent ever, and legally minimise the taxes to be paid, saving hundreds of thousands in the process. Moreover, tax is often a lucrative career path at accounting firms.

Photo Credit: Tingey Injury Law firm @ Unplash

I hope this article has provided a clear picture of what an Accounting degree may look like. I wish you all the best in your future endeavours.